Data is everywhere these days. If you are in any form of marketing, advertising, market research, or related field, you’re likely overwhelmed with just how much data is available at your fingertips at any given time.

Website visits. Social media likes, follows, and shares. Conversion clicks on call-to-action buttons. All of these activities are expressing decisions consumers make. While the ultimate goal is to lead consumers to purchase something, these other activities still captured their time and attention.

But there is a danger in only following this type of data. The danger lies in what many have chosen to ignore, as technology makes it increasingly easy to chart consumer behaviors. And that is the true voice of the customer. Because, while metrics that report behaviors may be relatively reliable indexes of past events, they often are woefully ill-equipped to capture consumers’ sentiment, motivators, and emotional drivers—all of which happen before a button is clicked, a survey question is answered, or a purchase is made.

When market research techniques are applied objectively, an in-depth understanding of customer attitudes, preferences, and buying motives can be gained.

What is voice of the customer (VoC) research?

Voice of the customer (VoC) research is the process of discovering the needs and wants of customers through quantitative and qualitative research. It is used to capture the voice of respondents to better measure and understand both customer satisfaction and loyalty.

Surveys offer an efficient way to conduct VoC research. However, quantitative data gathered in surveys can be ubiquitous. A modern trend in survey deployment has placed little to no emphasis on open-ended questions. Yet, it is these qualitative questions—the questions asking “why”—that are integral to capturing the complete picture. Open-ended questions (in surveys, online bulletin boards, or person-to-person discussions) present an opportunity to ask a respondent, “Why? Why did you answer B? How long have you felt that way? Could something change your mind, in a perfect world? If B wasn’t an option, what would you have said, in your own words?”

These qualitative insights into how customers feel about a product, service, competitor, or the category in general are extraordinarily valuable. VoC research helps to capture the motives behind consumer engagement, purchases, and brand loyalty, providing a considerable advantage to those who choose to engage in this type of research.

True voice: customers will tell you what they want, if only you’re willing to listen

To find the true voice of the customer, VoC research should encourage people to share their thoughts and answer “why.” Examining a customer’s full response (in any open-ended context) is critical to understanding the decision-making process. However, as much as customers must be willing to share, researchers and leadership teams must also be willing to listen. Finding the true voice of the customer requires researchers and executives to be objective, open, and active listeners. While cognitive biases are a natural part of our thinking, biases must be checked when conducting any type of market research. Assumptions left unchecked can cause organizations to lose millions of dollars. Organizations must look beyond internal expectations and agendas to listen to what consumers in their market are saying. Meeting and exceeding customer expectations is the best way to maximize relevancy, market share, and brand longevity.

How to avoid common mistakes in VoC research

In the journey to discovering true voice, there are some common pitfalls that appear within VoC research. Research design, tools used, and company vision are just a few obstacles that can impact a study’s overall success. Because of the complexity behind human behavior, it is vital that the party configuring the study has the expertise to mitigate these avoidable mistakes.

The research performed should be carefully realized, with questions that are carefully plotted to get the right information from the right people. Every question should lead to meaningful, measurable, and actionable insights. If a question strays too far from the research project scope, do not include it. Respondents’ time is as valuable a resource as ever. Researchers are competing for respondents’ time, both on- and off-line—with flexibility becoming an important factor in any research program. Therefore, the respondent experience must be concise and one in which they feel heard and free to express their opinions.

There is too much at stake for brands to rely on insufficient—or worse, misinterpreted—data. Mining a customer’s true voice is impossible without the effective and strategic marriage of both quantitative and qualitative methodologies. Some of the biggest companies have fallen victim to relying on faulty data, often to the detriment of their brands. The more leadership teams are equipped with reliable and actionable data, the better their brands, products, and services will connect with their desired customers.

Layer your VoC program with emotion research

Understanding the true voice of the customer will reveal some of the emotional drivers behind the decision-making process. Once key emotions are deciphered, these emotions can be marketed and messaged to, creating customer experiences that build brand affinity, distinction, magnetism, and loyalty. Emotion Intelligence can be layered over your VoC data to uncover consumers’ hidden opinions and associations. It can be used to gain an unquestionable understanding of the drivers behind consumer attitudes and behavior.

Based on Plutchik’s Wheel of Emotions, Martec’s patented emotion research algorithms uncover the hidden sentiments, opinions, and associations that consumers have. The technology is simple, yet versatile, and can be applied to a range of possible data sources—surveys, research reports, social feedback, online product reviews, and more.

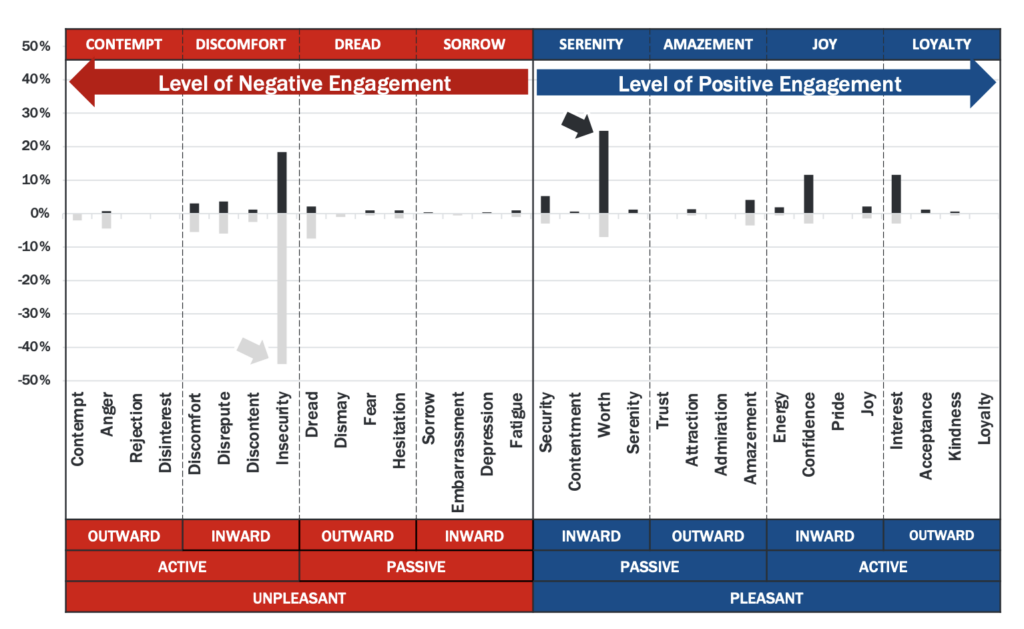

Emotion Intelligence uses language to reveal nonconscious or unstated emotions. Martec’s Emotion Landscape takes each word elicited within discussion transcripts, survey results, or social media activities and charts each into one of 32 emotion channels. After the words are mapped, an Emotion Landscape is generated (see an example from our Clean Label study below). The Emotion Landscape reflects the degree to which each emotion is felt … sometimes what is stated does not match underlying intensities.

Another tool utilized within Emotion Intelligence is the Martec Emotion Score (MES), a new metric for understanding and quantifying emotional connection and engagement. Based on a ratio of pleasant to unpleasant emotion words, a score is calculated to provide a relative idea of how consumers react to a specific idea. (For example, referencing our Clean Label study again, on a scale of 0 [neutral] to 100 [top level of positive engagement], the MES for reading ingredients on a food label is: -20 … indicating there’s work to be done to help consumers feel better about long and complicated ingredient labels.)

Martec’s Emotion Intelligence capabilities combined with a VoC research program can provide invaluable insights into the minds of your targeted customers. Contact us for a deeper conversation about VoC research and your organization’s goals at large.